With Diets and Budgets, Sheer Willpower is Not Enough

Like diets, budgets are often less about the ‘what’ and more about the ‘how.’

Often we know that we need to spend less and exactly where we need to do so. Much in the same way that someone who wants to lose weight knows that they shouldn’t eat desserts or should stop eating after 8:00pm, most of us know that we shouldn’t purchase another pair of shoes, upgrade to the latest device, or go out to dinner and drinks with friends (again!) if we’re having trouble paying our bills.

We know the what. But the problem is how do we do this?

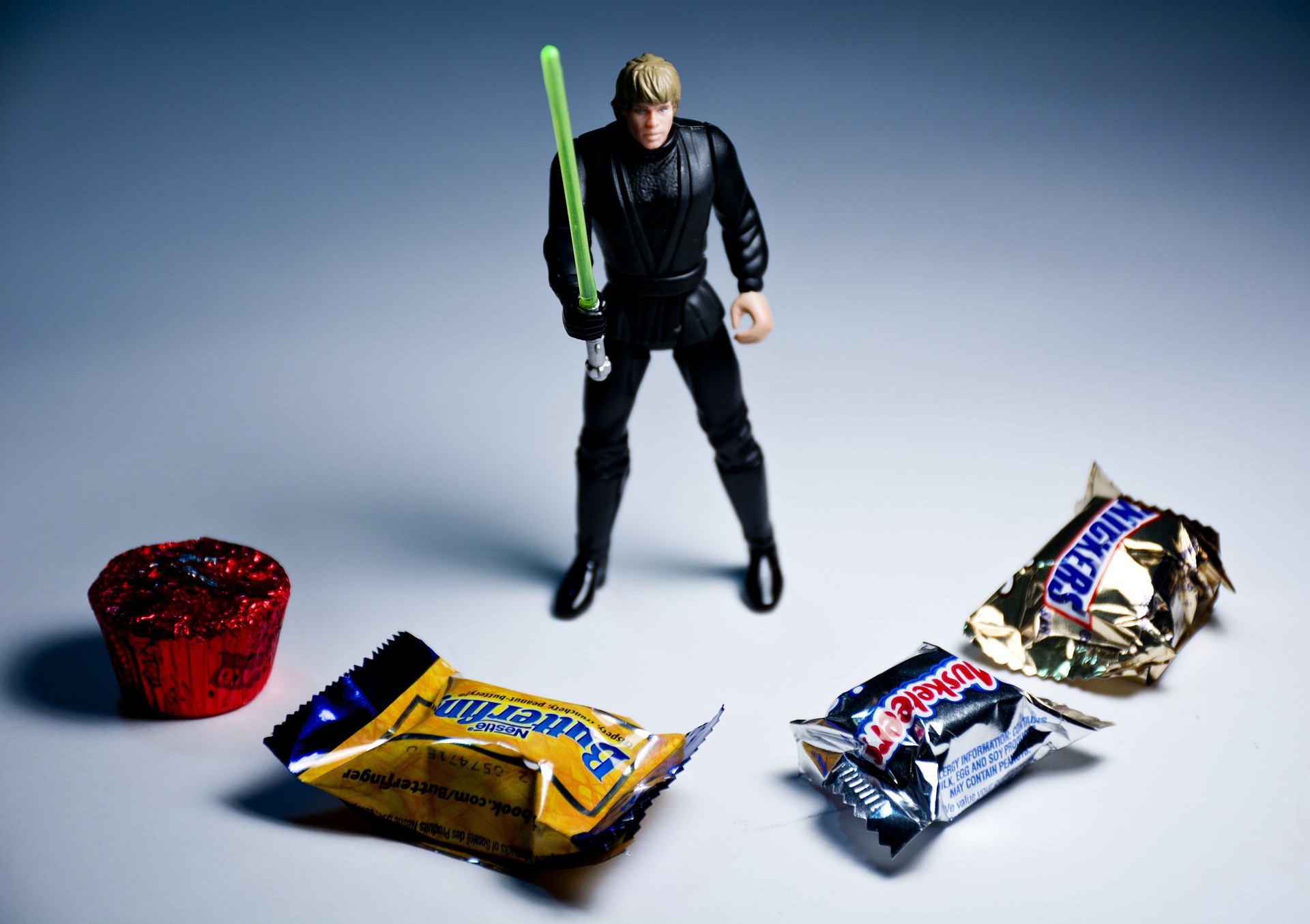

How, exactly, do we choose kale over doughnuts, retirement contributions over Louis Vuittons?

The common approach that most people default to is to use willpower. After a mini brain tantrum ensues in their heads, where a “should” is battling against a “shouldn’t,” they momentarily resist the doughnut or muster up the motivation to say “No, thanks, another time” to a friend’s request to go out to dinner – often through sheer willpower. A small victory is won.

But the problem with using willpower alone is that…

It’s [*add expletive here] hard!

This is especially true if you are repeatedly asked to exert willpower over an extended period of time. Known as ‘willpower depletion,” the theory suggests that each person has a certain “reserve” of willpower that can actually be reduced and become weaker over time. This is why we may start off easily being able to ward off a temptation at the early stages of a diet or budget, but after a few days, we feel fatigued and may give in or binge with out of control eating or spending.

So, while using willpower is certainly important when making a dietary or financial change, willpower alone is not enough. Whether you need to eat better or spend less, your plan will have much more success if, in addition to willpower, you include these three related strategies:

1) A New Environment: This is not brain science, but I’m often surprised by how little people take advantage of this strategy. What is one piece of advice that nutritionists and other weight loss experts suggest when helping someone to embark on a new eating plan? Change Your Environment. With diets, this usually means: clean out your pantry and get rid of all the unhealthy foods that may tempt you throughout the day.

Similarly, with a budget, you need to change your environment. This may mean spending time with different friends who may be interested in spending less as well; identifying specific, fun low-cost activities that replace some of the other activities that might have been more expensive, such as learning how to cook, reading, running or playing a sport, meditation, etc., or limiting the amount of time you spend on social media.

The key here is that you don’t want to feel deprived, like one of my clients was feeling every time she vowed to stay in on a Thursday night instead of go out with her friends. I immediately noticed this and had her come up with some fun things to do to replace her previous activities, otherwise we both knew that within a month she would be abandoning her budget because it felt too challenging.

One week she decided to rent a great movie that had been on her “must watch” list but she never seemed to get around to watching it; another week she planned a “power” walk with a neighbor; another she bathed and groomed her dog to the nines and posted cute pictures of her on Instagram.

They were minor adjustments, but by planning ahead and making sure she had something to do instead of sitting at home and stewing about the fact that her friends were out at a restaurant, she had more long-term success sticking with her budget. She changed her environment.

2) Visualizations: High-performing athletes have long used the power of visualization to accomplish their goals, so why not use it when trying to stick with your budget? Visualizations actually help to strengthen your willpower “muscle”, so when it actually comes down to resisting an urge, you are much better prepared.

A key aspect of visualization is to not merely visualize your success in reaching your goal, but to practice visualizing your success in overcoming the obstacles to get there. For example, for marathon training, it’s often not enough to visualize crossing the finish line; what’s more effective in reaching that goal is to actually practice visualizing the pain you might feel in mile 13 or 17 and pushing through it.

When reaching your financial goals, therefore, don’t just visualize having no credit card debt, or saving money to pay for a trip you’ve been dying to take. Also include images of you passing your favorite store and having no desire to go in, or creatively coming up with a meal from leftovers instead of paying for more expensive take-out. Visualizing the steps to get you to your goal can be much more effective in your process than visualizing the success of the goal itself.

The second key to visualization is to practice it. Like meditation, one time is helpful but certainly not life-changing. In order for it to make a real difference, schedule a few minutes on your commute or when you are enjoying your morning coffee to practice it on a regular basis (at least weekly).

3) Focus – Have just ONE goal: It’s no surprise that having too many goals at once will drain your energy – and your willpower. When one is starting a weight loss plan, for example, experts often advise to focus on eating first, and not worry about exercise initially (or vice versa); this is often because the brain cannot handle trying to change too many things at once over a sustained period of time. By nature, it likes to be efficient and changing too many things at once and having too many things to focus on will begin to create brain fatigue.

When it comes to your budget, for example, you may want to begin by focusing on tracking your spending for a week, not making any changes yet but simply tracking it because you are generally not used to doing this. Once you have that down, you can then add other changes. Or you may want to begin by cutting spending in one category initially, e.g., dining out, rather than also slashing your clothing and travel budget. (Of course, you don’t want those categories to increase while you’re trying to decrease another – because then your overall spending stays the same or may increase! – but it may be wise to focus on only one area to reduce initially.)

We all know we need to choose kale over doughnuts, and retirement over new shoes. Now, hopefully, you also know how you can make those choices a little bit easier.