The Whole 30 and an End to Yo-Yo Budgeting

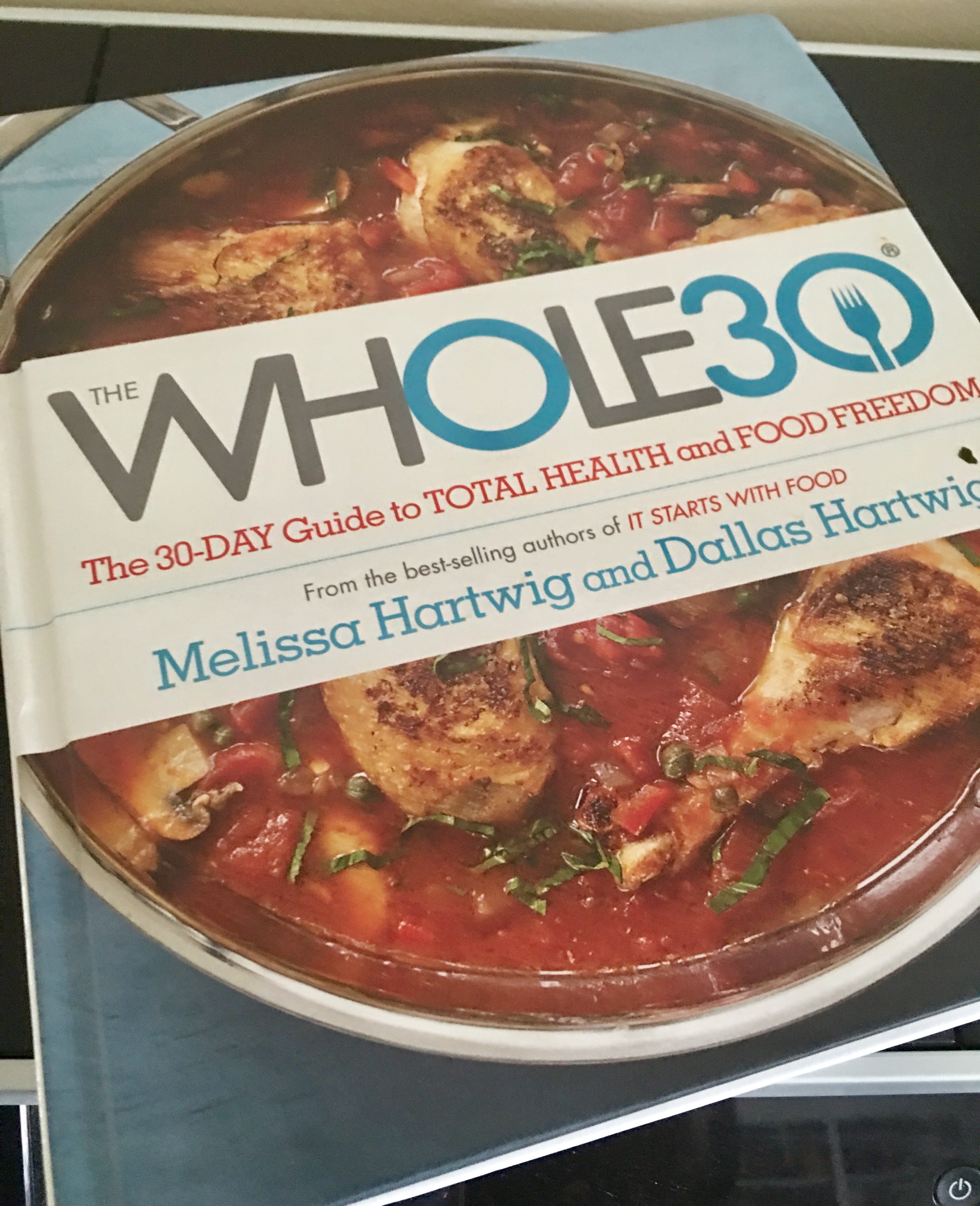

This past January I completed The Whole 30. If you don’t know what Whole 30 is, it is a 30-day eating regimen where you commit to consuming only fruits, vegetables, meat, chicken, eggs, nuts (except peanuts) and limited fats. No sugar (or sugar substitutes like agave, honey, etc.), no dairy, no grains, no alcohol, and absolutely nothing processed.

30 days is a long time.

30 days is a long time.

I won’t lie. It was hard. It required preparation, forming new habits, and mental discipline.

And then, much to my dismay, I soon realized that my work was not yet over! After the 30 days had passed, I discovered that there was this entire second stage, where I had to re-introduce all those foods that I temporarily eliminated and figure out how to add them back into my routine in a way that was healthy and balanced.

By design, the program isn’t meant to last forever (hence the name. It’s not called Whole Eternity!). It’s meant to be a re-set. But after the initial cleanse is done, the real work begins as you let go of yo-yo dieting once and for all. You learn how to pay attention to how your body reacts as you re-introduce various foods back into your diet. Eventually, you no longer need strict rules dictating what you can and cannot eat bc you are naturally attuned to when it was okay to indulge a bit vs. moments that called for a bit more self-discipline.

How Whole 30 applies to your Money

In many ways, Whole 30 is very similar to what I teach my clients about budgeting and their personal finances.

Strict budgeting – as in tracking every single expenditure and inflow- is not meant to last forever. With most of my clients, it’s usually longer than 30 days, but it’s definitely not intended to last a lifetime (no Whole Budgeting Forever here!).

Like Whole 30, it’s meant to be a re-set. Committing to a strict budget for a period of time can help you get a good dose of reality – like calorie counting or a cleanse. It can help you get a fresh start on your money, as you figure out where you may have been overindulging and where there are opportunities for cutting back.

I won’t lie, like Whole 30, it can be hard. It may require preparation, forming new habits, and mental discipline.

And importantly, the initial budgeting period is only one stage. The second phase, like the month of February on Whole 30 has been for me, may require another kind of discipline as you begin to let go of the strict rules that perhaps someone else (like me or another coach or advisor) has set for you and start paying attention to what works specifically for you and the personal goals you want to achieve in your life.

In this stage, I coach clients on taking full ownership of their financial choices. I give them tools on how to make better financial decisions and on how to balance their long-term dreams (like buying a house, funding a new business or education for their kids) with their short-term spending (like take-out or Netflix). I help them to create new money stories that are motivating and resonate for them personally, so they can create habits that stick. I also can schedule regular check-ins so they can still have support when they need it.

I’m often asked, is it worth it? With regards to Whole 30, I’m still in the early stages, but my current recommendation is absolutely. I’ve lost seven pounds, sleep better, feel less bloated, and no longer crash mid-afternoon but feel energetic consistently throughout the day. I’ve reintroduced foods but generally have chosen to stay away from bread, sugar and processed foods with the occasional exception that feels healthy and sustainable.

With regards to budgeting and money in general, no surprise here… my answer is absolutely! I’ve seen 180 degree transformations in clients, some of whom had no idea what was in their checking accounts but who now actually look forward to tracking their money every day. Clients who are now confident in the price they are paying for a home because they know they can afford it. Clients who have a plan to pay off their student loans but can still feel guilt-free when they go out to dinner because they know how it’s being paid for.

Is it hard? Yes.

Is it worth it? Absolutely.

To find out more about budget coaching, email jennifer@financialwealthbeing.com